Abstract

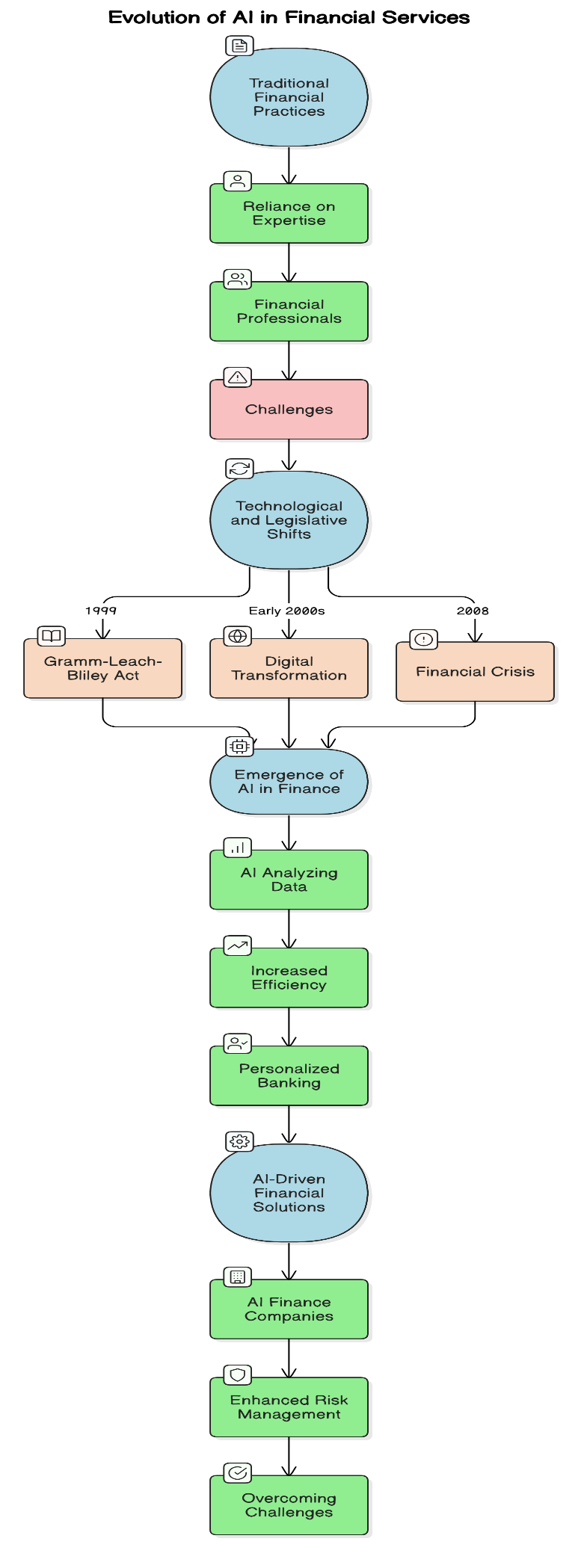

Artificial intelligence (AI) is transforming the financial sector by revolutionizing risk management and enhancing personalized banking experiences. This study examines the role of AI in finance by analyzing how companies such as AlphaSense and Kasisto utilize AI-driven solutions to optimize financial decision-making and customer interactions. AI’s advanced capabilities in data analysis, credit underwriting, and automated customer service have significantly enhanced efficiency, accuracy, and accessibility within the financial services sector. The paper explores key AI technologies, including machine learning, natural language processing (NLP), and generative AI, which drive this transformation. Despite its numerous advantages, the integration of AI in finance presents challenges such as data privacy concerns, ethical considerations, and regulatory compliance. The study highlights the importance of addressing these challenges to ensure the responsible and sustainable adoption of AI in the financial sector. By showcasing the contributions of leading AI-driven financial solutions, this research provides valuable insights into the evolving financial landscape and the potential of AI to redefine financial services, making them more inclusive, efficient, and secure.

Data Availability Statement

Data will be made available on request.

Funding

This work was supported without any funding.

Conflicts of Interest

Raja Vavekanand is an employee of Datalink Research and Technology Lab, Islamkot 69240, Sindh, Pakistan.

Ethical Approval and Consent to Participate

Not applicable.

Cite This Article

APA Style

Madiha, M., Sam, K., Kumar, S., & Vavekanand, R. (2025). Case Studies on Integrating Artificial Intelligence in Finance to Transform Decision Making and Risk Management for Enhanced Financial Outcomes. IECE Transactions on Computer Science, 2(2), 35–50. https://doi.org/10.62762/TCS.2025.744196

Publisher's Note

IECE stays neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Institute of Emerging and Computer Engineers (IECE) or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Submit Manuscript

Edit a Special Issue

Submit Manuscript

Edit a Special Issue